Even as inflation and cost-of-living concerns weigh on UK households, online shopping habits are telling a different story. According to new data, 30% of UK online shoppers now spend over £100 a month online—a figure that would have seemed unlikely just a few years ago. Far from slowing down, eCommerce is becoming a central part of how people shop, budget, and live.

In this report, we unpack key findings from the 2025 Online Consumer Landscape Study, exploring what’s behind this rise in digital spending—from the growing influence of heavy shoppers to the demand for personalisation, transparency, and convenience. The numbers reveal a retail environment that’s evolving fast.

Digital Spending Rises in the UK Despite Economic Pressures

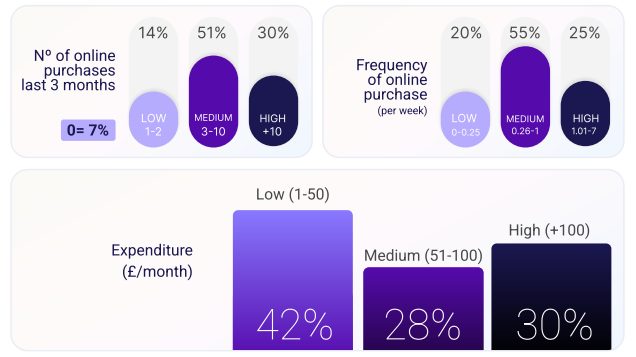

According to our 2025 Online Consumer Landscape Study—based on responses from 2,500 consumers across five major European markets—digital spending habits in the UK are showing remarkable resilience. UK consumers who shop online now spend an average of £89 per month on digital purchases, significantly above the European average of £73.

While the data focuses on consumers who have made at least three online purchases in the past three months, it points to a high-value segment that is both engaged and steadily growing. Notably, nearly one in three UK online shoppers (30%) now spend over £100 each month. This marks a clear shift in behaviour, with more consumers treating online shopping as a regular part of daily life rather than an occasional activity.

As eCommerce becomes more deeply embedded in routine consumer habits, these trends signal a strong opportunity for businesses to engage with an increasingly committed base of high-frequency, high-spending digital shoppers.

Access the full report. For a deeper look at how UK consumers are spending online in 2025—including breakdowns by category, age group, and shopping frequency—download the full Online Consumer Landscape Study.

Online Shopping Becomes Routine for UK Consumers

- 30% of UK consumers now spend over £100 per month on online shopping.

- 22% of shoppers plan to increase their online spending in 2025.

- The average monthly spending in the UK is £89, outpacing the European average of £73.

- 75% of UK shoppers regularly compare prices, features, and reviews before making a purchase, indicating a strong demand for transparency and clear product information.

- Only 12% of UK consumers cite price as the primary factor influencing their decision to shop online. Instead, factors like convenience, variety, and ease of comparison are taking precedence.

- Personalisation continues to be a key trend, with 23% of consumers willing to share personal data in exchange for a more tailored shopping experience.

The data shows a shopper who knows what they want, and isn’t just chasing the lowest price. UK consumers are spending more, comparing more, and expecting better. Convenience, variety, and a smooth experience now carry more weight than cost alone.

Personalisation isn’t just a nice-to-have; for nearly a quarter of shoppers, it’s worth exchanging data for. For online retailers, the challenge is no longer just getting people through the digital door—it’s earning their trust, attention, and repeat visits.

The Rise of Heavy Online Shoppers

These shifting expectations aren’t just shaping how people shop—they’re creating a new kind of customer. Heavy online shoppers now make up 38% of the UK market. Over 70% of them spend more than £50 a month, and two-thirds shop at least once a week.

This group is more than just high-spending. They’re consistent, engaged, and increasingly influential. They expect smooth experiences, personalised recommendations, and platforms that keep up with their pace. For retailers, they represent both a challenge and a clear opportunity.

Why Personalisation Matters More Than Ever

We’ve already mentioned personalisation more than once—and that reflects its growing role in how people shop online. It’s no longer a nice-to-have. As digital storefronts grow more crowded, 23% of UK consumers say they’re willing to share personal data in exchange for a more tailored experience. They want recommendations that reflect what they’ve bought, what they’ve browsed, and what actually interests them.

This shift in expectations is especially visible among frequent shoppers, who are raising the bar for what a good online experience looks like. Relevance, speed, and ease now matter just as much as price or product.

A Look at Online Spending by Category

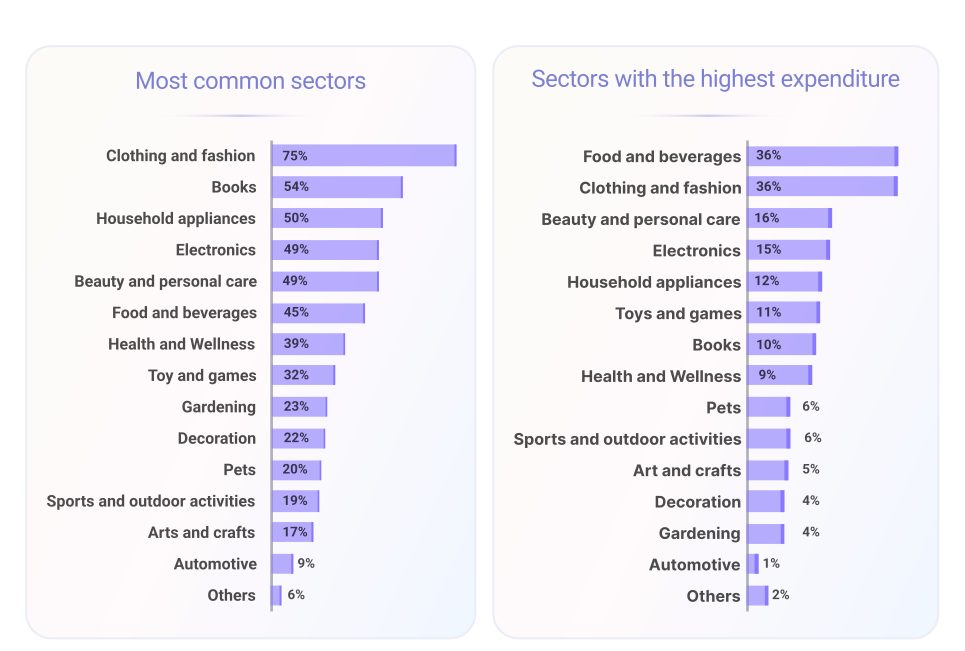

UK consumers are spending across a wide range of online categories, with fashion at the top—75% of shoppers regularly buy clothing and accessories online. Other popular categories include books (54%), household appliances (50%), and electronics (49%), showing strong demand for both practical needs and lifestyle-driven purchases.

Interestingly, food and beverages, though not the most frequently purchased, make up a large share of total online spend, pointing to steady growth in online grocery and everyday essentials. Meanwhile, rising interest in beauty, wellness, and personal care suggests that eCommerce is not just for occasional buys, it’s for all daily products.

Looking Ahead: What’s Driving the Next Phase of eCommerce

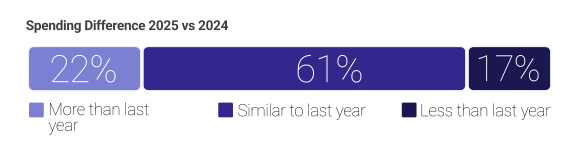

As we look ahead to 2025, the outlook for eCommerce in the UK remains positive. With 22% of consumers planning to increase their online spending, businesses should be prepared for continued growth and competition. The key to success will lie in staying ahead of consumer expectations, offering personalised experiences, and ensuring that the shopping process is both smooth and engaging.

In conclusion, these eCommerce statistics confirm that online shopping is now deeply embedded in daily life. For businesses, this surge in consumer spending represents both a challenge and an opportunity. By focusing on personalisation, transparency, and convenience, eCommerce brands can position themselves to meet the needs of the next generation of digital shoppers—and reap the rewards of a growing, high-value consumer base.

For more detailed insights, download the full 2025 Online Consumer Landscape Study for free.