CONTENTS

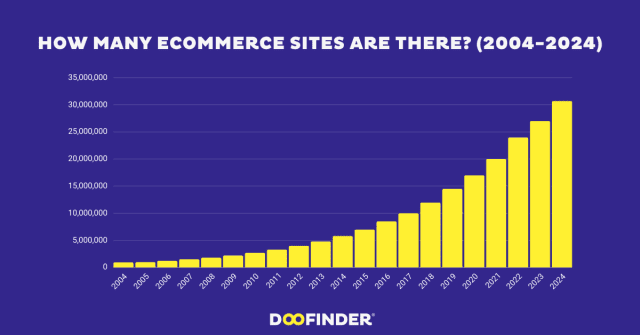

Buy Now, Pay Later (BNPL) has become one of the most transformative forces in consumer finance over the last decade.

What began as a niche payment option has grown into a global industry reshaping how people shop, pay, and manage their budgets.

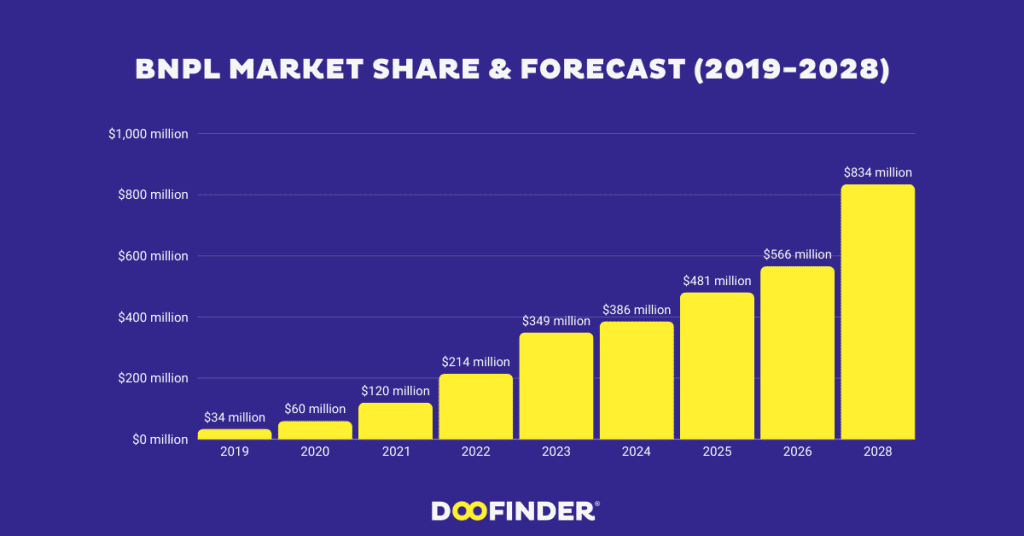

Starting with a modest BNPL market size of $34 billion in 2019, the buy now pay later market is forecasted to reach an astounding $834 billion by 2028.

This remarkable BNPL growth highlights the evolving needs of modern consumers and the opportunities for businesses to adapt to this new era of flexible financing.

The Year-by-Year Growth of BNPL

2019: The Beginning

- Market Size: $34 billion

The BNPL market share was still small in 2019, largely limited to early adopters. However, its potential was clear, particularly as eCommerce began expanding globally.

2020: Pandemic Sparks Adoption

- Market Size: $60 billion (+76% growth)

The COVID-19 pandemic accelerated the growth of BNPL, with consumers seeking more flexible ways to manage their finances during lockdowns. The BNPL market growth during this period was driven by its increasing integration into eCommerce platforms.

2021: Mainstream Success

- Market Size: $120 billion (+100% growth)

By 2021, the buy now pay later market size doubled, thanks to widespread adoption among Millennials and Gen Z. Retailers began to realize how offering BNPL could increase conversion rates and customer satisfaction, further boosting the buy now pay later market share.

2022: Surpassing $200 Billion

- Market Size: $214 billion (+78% growth)

The BNPL market growth continued at a rapid pace, driven by new players entering the industry and existing providers scaling their operations globally. By this time, the BNPL industry growth had firmly established it as a mainstream financial tool, not just in retail but also in other sectors.

2023–2028: The Future Forecast

- 2023: $349.4 billion (forecast)

- 2024: $386 billion (forecast)

- 2025: $481 billion (forecast)

- 2026: $565.8 billion (forecast)

- 2028: $834 billion (forecast)

The projected buy now pay later growth reflects the expansion of BNPL into new industries like healthcare, travel, and education.

As the buy now pay later market matures, it is expected to account for an even larger BNPL market share across global transactions.

What’s Driving the Growth of BNPL?

- Consumer Preferences for Flexibility

Younger generations prefer payment options that allow them to avoid traditional credit card debt. The transparency and simplicity of BNPL have made it a preferred choice, fueling the BNPL industry growth. - The eCommerce Boom

The buy now pay later market size has expanded significantly due to its seamless integration into online shopping platforms. Retailers adopting BNPL solutions have reported higher cart completion rates, contributing to the BNPL market growth. - Global Reach

Providers are targeting emerging markets, where access to traditional credit is limited but demand for financial flexibility is high. This expansion is a key driver of the growth of BNPL. - Diverse Use Cases

Beyond retail, the buy now pay later market is finding new applications in travel, healthcare, and even education. These diverse use cases are opening up new avenues for BNPL growth.

The Future of the BNPL Market

The buy now pay later market size has grown from $34 billion in 2019 to a forecasted $834 billion in 2028, cementing its place as a financial revolution.

The BNPL market growth story showcases how consumer demand for flexibility, coupled with eCommerce expansion, can drive industry transformation.

However, as the BNPL market share increases, providers must balance rapid expansion with consumer protection and sustainable practices. By addressing these challenges, the growth of BNPL can continue to shape the future of global finance.

The buy now pay later market is no longer just an alternative payment option—it’s a cornerstone of modern financial systems, offering consumers and businesses unparalleled opportunities for growth and innovation.

Source Acknowledgment: We base our content on credible sources like Statista, Insider Intelligence, Data Reportal, and Census.gov, recognized for their accuracy and reliability, thereby ensuring the credibility of the information we provide.